Auto Innovations Hub

Explore the latest trends, news, and insights from the automotive world.

Insurance Is Not a Four-Letter Word for Small Businesses

Unlock the truth: Insurance empowers small businesses! Discover why it’s vital for your success and how to make it work for you.

Understanding the Benefits of Insurance for Small Businesses

Understanding the benefits of insurance for small businesses is essential for safeguarding not just your investments, but also your business's longevity. Firstly, having insurance protects your company from unexpected events that could lead to financial loss. For instance, property insurance can cover damages caused by natural disasters, theft, or vandalism, ensuring that you can recover quickly. Moreover, liability insurance protects against claims made by third parties for injury or damage, mitigating potential legal costs. According to the Small Business Administration, small businesses with insurance are far better equipped to weather industry uncertainties.

Furthermore, insurance for small businesses can enhance your credibility with clients and partners. When clients see that you're covered by comprehensive insurance, it builds trust and confidence in your operations. Additionally, many clients prefer to work with businesses that have liability insurance, as it ensures protection for both parties involved. A good policy can also provide peace of mind to you as a business owner, allowing you to focus on growth and innovation without constantly worrying about unforeseen incidents. For more insights, you can explore the benefits of business insurance through NerdWallet.

Top 5 Common Insurance Myths Small Business Owners Should Know

As a small business owner, navigating the world of insurance can be daunting, especially with the prevalent myths that can lead to poor decision-making. Myth #1: Small businesses don’t need insurance. Many entrepreneurs mistakenly believe that since they’re small, they’re not at risk. In reality, every business, regardless of size, can face unforeseen challenges like accidents or lawsuits. According to the Small Business Administration, having adequate insurance is critical for protecting your investment and ensuring long-term stability.

Myth #2: Home-based businesses don’t require separate policies. Many small business owners who operate from home assume their homeowner's insurance will cover their business activities. However, typical homeowner policies often exclude business-related incidents. It’s essential to check with your insurer and, if necessary, obtain a home-based business insurance policy to ensure full protection. Educating yourself about these common misconceptions can empower you to make better-informed decisions about your business's future.

Is Your Small Business Covered? Key Insurance Policies You Might Need

As a small business owner, understanding whether your small business is covered involves evaluating a variety of essential insurance policies. Each type of coverage plays a crucial role in protecting your business's assets and ensuring its longevity. Here are some key policies you might need:

- General Liability Insurance: This protects against claims of bodily injury, property damage, and personal injury.

- Property Insurance: Covers damages to physical assets, such as buildings, equipment, and inventory.

- Workers' Compensation Insurance: Essential if you have employees, this covers medical expenses and lost wages if an employee is injured on the job.

For more detailed information, you can visit SBA’s guide on small business insurance.

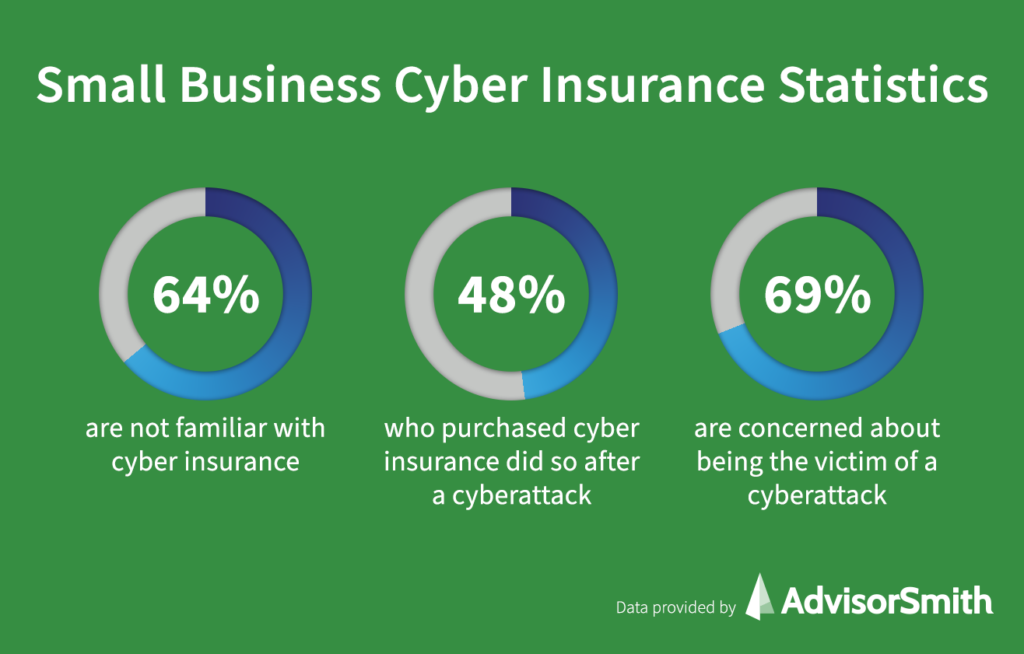

Furthermore, it's vital to consider additional coverage options tailored to your specific business needs. Professional Liability Insurance is key for service-oriented businesses, offering protection against claims of negligence or errors. Additionally, Cyber Liability Insurance is becoming increasingly important in today's digital landscape, safeguarding against data breaches and cyber threats. Ensure you assess your specific risks to determine the best coverage for your circumstances. For further insights, check out Nolo's overview on business insurance.