Auto Innovations Hub

Explore the latest trends, news, and insights from the automotive world.

Flip the Script: Navigate CS2 Trading Reversals Like a Pro!

Unlock the secrets of CS2 trading! Master reversal strategies and boost your profits with our pro tips in Flip the Script. Dive in now!

Understanding Market Psychology: Key Indicators of CS2 Trading Reversals

Understanding market psychology is crucial for traders looking to anticipate potential trading reversals, particularly in CS2 trading. Market psychology refers to the collective behavior of market participants, influenced by emotions such as fear and greed. Recognizing key indicators can help traders identify significant shifts in market sentiment. For instance, a sudden spike in trading volume can indicate a change in the momentum of CS2 assets, signaling a potential reversal ahead. Additionally, monitoring the Relative Strength Index (RSI) can provide insights into whether an asset is overbought or oversold, further aiding in trading decisions.

Another vital component of understanding market psychology involves tracking sentiment through tools like the Fear and Greed Index. This index categorizes market sentiment on a scale from extreme fear to extreme greed, allowing traders to gauge the overall mood of the market surrounding CS2 assets. When the market leans towards extreme fear, it may suggest an opportunity to buy, as reversals in such conditions often lead to price recoveries. Conversely, during periods of extreme greed, traders should be cautious, as reversals may occur with increased volatility. By integrating these psychological indicators into their trading strategy, traders can enhance their ability to spot CS2 trading reversals.

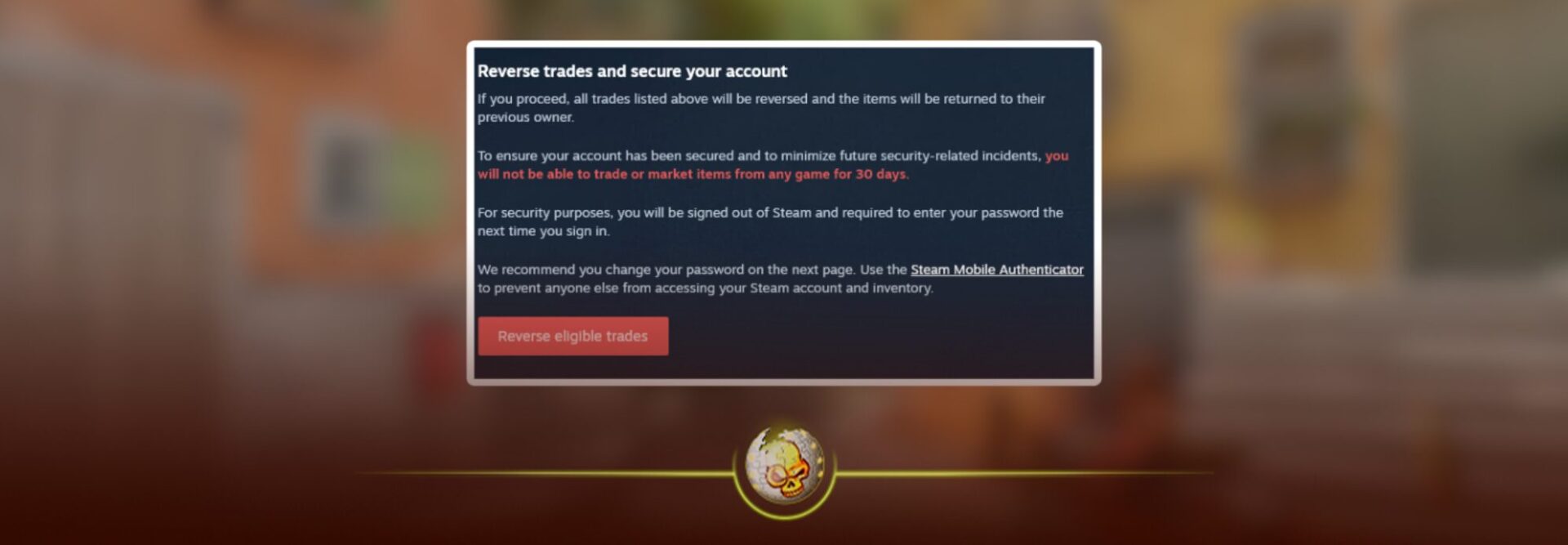

Counter-Strike is a highly competitive first-person shooter game that emphasizes teamwork, strategy, and quick reflexes. Players can engage in various game modes, and for those interested in enhancing their gaming experience, a trade reversal guide can provide valuable insights on in-game transactions. With its rich history and evolving gameplay, Counter-Strike continues to attract millions of players around the world.

Top 5 Strategies for Spotting CS2 Trading Reversals Before They Happen

In the fast-paced world of CS2 trading, identifying potential reversals before they happen can significantly enhance your trading strategy. One of the top strategies for spotting these reversals is to closely monitor price action. By analyzing historical price movements and recognizing patterns such as double tops and bottoms, traders can predict possible shifts in market direction. Additionally, utilizing tools like moving averages can help to smooth out price fluctuations, making it easier to spot when a reversal might be imminent.

Another effective method is to pay attention to trading volume. A sudden spike in volume, especially following a period of consolidation, often indicates that a significant price move is on the horizon. Furthermore, incorporating technical indicators such as the Relative Strength Index (RSI) can provide insights into whether a currency pair is overbought or oversold, adding another layer of analysis to your reversal spotting tactics. By combining these strategies, traders can improve their chances of successfully predicting market movements before they fully materialize.

How to Manage Risk When Navigating CS2 Trading Reversals

Trading reversals in CS2 can be both an opportunity and a challenge for traders. To effectively manage risk, it is crucial to establish clear entry and exit points before making a move. Consider utilizing a stop-loss order, which automatically closes your position when it reaches a predetermined price, to protect your capital. Additionally, employing technical analysis tools, such as moving averages or support and resistance levels, can provide insights into market trends and potential reversal points, enhancing your decision-making process.

Another vital aspect of risk management is to maintain a disciplined trading strategy. This includes diversifying your portfolio to spread risk across different assets rather than concentrating it on a single trade. Additionally, it's essential to remain updated with market news and trends that could influence price movements. By keeping emotions in check and adhering to your trading plan, you can navigate CS2 trading reversals with greater confidence while minimizing potential losses.