Auto Innovations Hub

Explore the latest trends, news, and insights from the automotive world.

Liquid Gold: Decoding the Secrets of Marketplace Liquidity Models

Unlock the secrets of marketplace liquidity! Discover how models impact success and boost your profits in our must-read guide.

Understanding Marketplace Liquidity: Key Models and Their Impacts

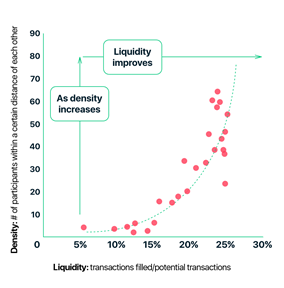

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without causing a significant impact on their price. Understanding liquidity is crucial for both investors and businesses, as it directly affects the efficiency of transactions and overall market stability. There are several key models that illustrate how liquidity operates, including the Order Book Model, the Continuous Double Auction, and the Central Limit Order Book. Each of these models provides insight into how trades are executed and how liquidity can fluctuate based on supply and demand dynamics.

The impacts of liquidity in a marketplace are profound and multifaceted. High liquidity typically results in narrower bid-ask spreads and lower transaction costs, making it attractive for traders looking to capitalize on short-term price movements. Conversely, illiquid markets can experience significant price swings, resulting in greater risks for investors. Moreover, the liquidity of a marketplace can influence overall investor confidence and market depth, which are essential for fostering healthy trading environments. Understanding these key models and their impacts can empower stakeholders to make informed decisions that align with their financial goals.

Counter-Strike is a highly popular first-person shooter game that has captivated millions of players around the world. Its competitive nature and team-based gameplay have led to a thriving esports scene. Players often look for ways to enhance their gaming experience, and using a daddyskins promo code can provide them with unique in-game skins and upgrades.

The Essential Guide to Enhancing Liquidity in Online Marketplaces

Enhancing liquidity in online marketplaces is crucial for both buyers and sellers, as it ensures a more efficient and effective trading environment. To achieve higher liquidity, marketplace operators should consider implementing various strategies, including competitive pricing, improving user experience, and leveraging technology. One essential approach is to create a seamless payment system that allows for quick transactions. When users can easily buy and sell products, it significantly increases the volume of trades, leading to enhanced liquidity. Additionally, fostering a sense of trust among users can encourage participation; sellers are more likely to list their products when they feel secure about their transactions.

Moreover, it is important to continually assess and adapt to the changing market dynamics. Utilizing data analytics can help operators identify trends and consumer behaviors, allowing them to make informed decisions. Another critical tactic is to engage with the community by promoting user-generated content and feedback, which can enhance the marketplace's visibility and appeal. To summarize, enhancing liquidity in online marketplaces is a multifaceted endeavor, encompassing efficient transaction processes, trust-building measures, and constant market analysis to ensure a thriving trading ecosystem.

What Are the Best Practices for Achieving Optimal Marketplace Liquidity?

Achieving optimal marketplace liquidity is essential for the fluid functioning of any trading environment, whether it be in financial markets or e-commerce. One of the best practices to enhance liquidity is to ensure transparent pricing. This can be achieved through real-time updates that reflect market conditions, enabling buyers and sellers to make informed decisions. Additionally, maintaining a consistent trading volume by attracting a diverse range of participants helps in creating a competitive marketplace, which in turn enhances liquidity. Offering incentives such as lower transaction fees or rewards for frequent trading can also encourage higher participation rates.

Another key practice is to leverage technology to streamline trading processes. Implementing advanced trading algorithms and high-frequency trading mechanisms can significantly boost market activity. Furthermore, optimizing user interfaces for both buyers and sellers facilitates quicker transactions, which aids in maintaining liquidity. Regularly gathering and analyzing data on trading patterns allows marketplace operators to identify trends and adjust their strategies accordingly. By focusing on these elements, marketplace creators can achieve the desired level of liquidity, thereby ensuring a more vibrant and efficient trading environment.