Auto Innovations Hub

Explore the latest trends, news, and insights from the automotive world.

Why Marketplace Liquidity Models Are the Unsung Heroes of the Trading World

Discover why marketplace liquidity models are the secret backbone of successful trading—unveiling their impact on market dynamics and profits!

Understanding Marketplace Liquidity Models: Key to Seamless Trading

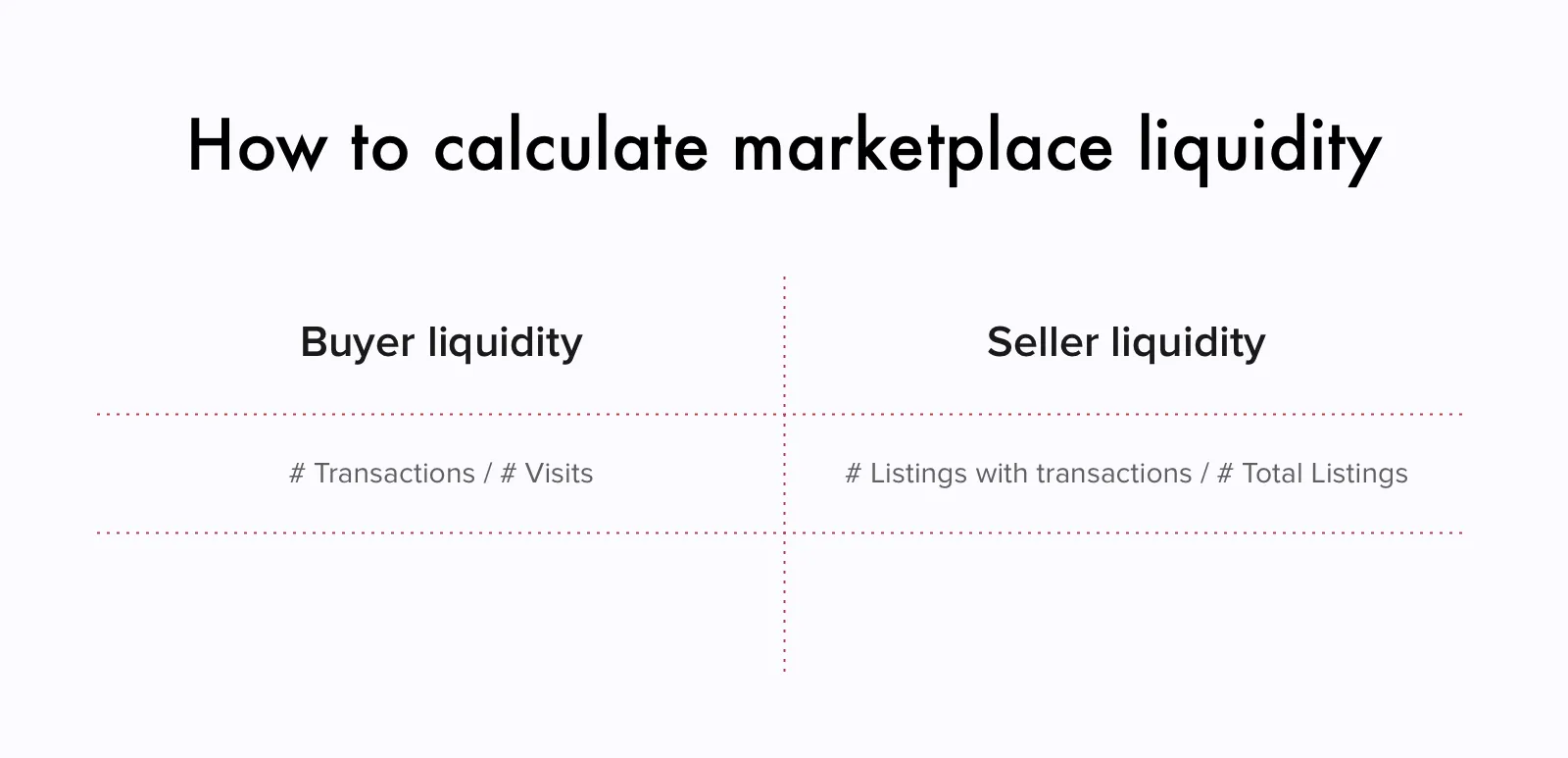

Understanding marketplace liquidity models is essential for both traders and platform operators to facilitate smooth and efficient trading experiences. At its core, liquidity refers to the ease with which assets can be bought or sold in a marketplace without causing a significant impact on their price. Various models exist, including order book systems, liquidity pools, and auction-based mechanisms. Each model has its own unique characteristics that cater to different trading styles and asset types, influencing the overall trading dynamics.

The key to achieving seamless trading lies in recognizing the strengths and weaknesses of these liquidity models. For instance, order book systems provide transparency and real-time price discovery, but can struggle during periods of high volatility. On the other hand, liquidity pools offer more consistent spreads and lower slippage, making them attractive for automated trading. Understanding these dynamics enables traders to adapt their strategies accordingly and choose the right platform that aligns with their trading goals.

Counter-Strike is a highly competitive first-person shooter that has captivated gamers since its release in the late 1990s. Players engage in intense team-based matches, often focusing on objectives such as bomb defusal or hostages rescue. For a boost in your gaming experience, you can check out the daddyskins promo code to enhance your arsenal with unique skins and items.

How Marketplace Liquidity Models Can Enhance Your Trading Experience

Marketplace liquidity models play a crucial role in shaping your trading experience by ensuring that assets can be bought and sold with minimal impact on their prices. High liquidity allows traders to enter and exit positions quickly without facing significant price slippage, which can be vital in volatile markets. When liquidity is abundant, traders benefit from narrower bid-ask spreads, making trading more cost-effective. Understanding the various liquidity models, such as centralized liquidity pools or decentralized exchanges, enables traders to strategically plan their trades and maximize potential profits.

Furthermore, effective liquidity models can enhance market resilience by providing stability during times of high demand or market stress. For instance, in a well-structured marketplace, liquidity providers can step in to absorb excess volatility, creating a more robust trading environment. This resilience not only attracts seasoned traders but also encourages new participants to engage in the market. By leveraging the advantages of advanced liquidity models, traders can improve their overall trading experience and make more informed decisions, ultimately leading to greater satisfaction and success in their trading endeavors.

Are Marketplace Liquidity Models the Backbone of Successful Trading?

In the ever-evolving landscape of financial trading, marketplace liquidity models serve as the backbone for successful trading operations. Liquidity refers to how quickly and easily assets can be bought or sold in the market without significantly impacting their price. Traders rely on robust liquidity models to facilitate their transactions, ensuring that they can enter and exit positions seamlessly. A highly liquid market not only minimizes slippage but also attracts more participants, creating a vibrant trading environment conducive to opportunity and growth.

Moreover, understanding different liquidity models is crucial for both institutional and retail traders. These models can vary, incorporating factors like market depth, order types, and the presence of market makers. By leveraging these insights, participants can better navigate the complexities of trading and enhance their strategies. Ultimately, the effectiveness of these models lays the groundwork for overall trading success, providing traders with the necessary tools to make informed decisions and maximize their returns in competitive markets.